401k to roth ira tax calculator

The calculator will estimate the monthly payout from your Roth IRA in retirement. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Traditional Vs Roth Ira Calculator

Explore Choices For Your IRA Now.

. Many new investors wonder if they should invest in a 401k or Roth IRA. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. New Look At Your Financial Strategy.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Traditional 401 k and your Paycheck. Visit The Official Edward Jones Site.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. It increases your income and you pay your. Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Traditional 401k Retirement calculators. This calculator will show the advantage.

How to pick 401k investments. How does a Roth IRA work. The Roth 401k is somewhat different from the traditional 401K as a retirement savings plan.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. New Look At Your Financial Strategy. Ad Learn More About American Funds Objective-Based Approach to Investing.

It combines some features of the traditional 401k along with some features of the Roth IRA. When planning for retirement there are a number of key decisions to make. Build Your Future With a Firm that has 85 Years of Investment Experience.

Roth Conversion Calculator Methodology General Context. Ad Explore Your Choices For Your IRA. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

This means you do not get a tax deduction for contributing to a Roth IRA but the benefits greatly outweigh this. Converting to a Roth IRA may ultimately help you save money on income taxes. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

The main benefits are Tax-Free withdrawals during retirement this includes any. 401k Roth 401k vs. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

For some investors this could prove. Because a standard 401 k is funded with before-tax dollars you will need to pay taxes on. Additional Roth IRA Calculators.

How much should you contribute to your 401k. Get Up To 600 When Funding A New IRA. Roth 401 k contributions allow.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Your IRA could decrease 2138 with a Roth. Reviews Trusted by Over 45000000.

There are many factors to consider including the amount to convert current tax rate and your age. Ready To Turn Your Savings Into Income. Visit The Official Edward Jones Site.

This means that there are tax consequences if you rollover a 401 k to Roth IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

Both are tax-advantaged retirement accounts but there are differences between the two. Compare 2022s Best Gold IRAs from Top Providers. This guide may be especially helpful for those with over 500K portfolios.

When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. Automated Investing With Tax-Smart Withdrawals. A Roth IRA is entirely useless if you dont spend the money in your Roth IRA.

Below the number one area for financial education Im going to go over 3 of the most effective Roth IRA. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. The information in this tool includes education to help you determine if converting your.

Since Roth IRA withdrawals in retirement are tax-free it would be worth more in retirement than 1000 in your taxable 401k account. Get Up To 600 When Funding A New IRA. A 401 k can be an effective retirement tool.

Roth Conversion Calculator Methodology General Context. Pros of Roth IRA. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

As of January 2006 there is a new type of 401 k contribution. Ad If you have a 500000 portfolio download your free copy of this guide now. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional.

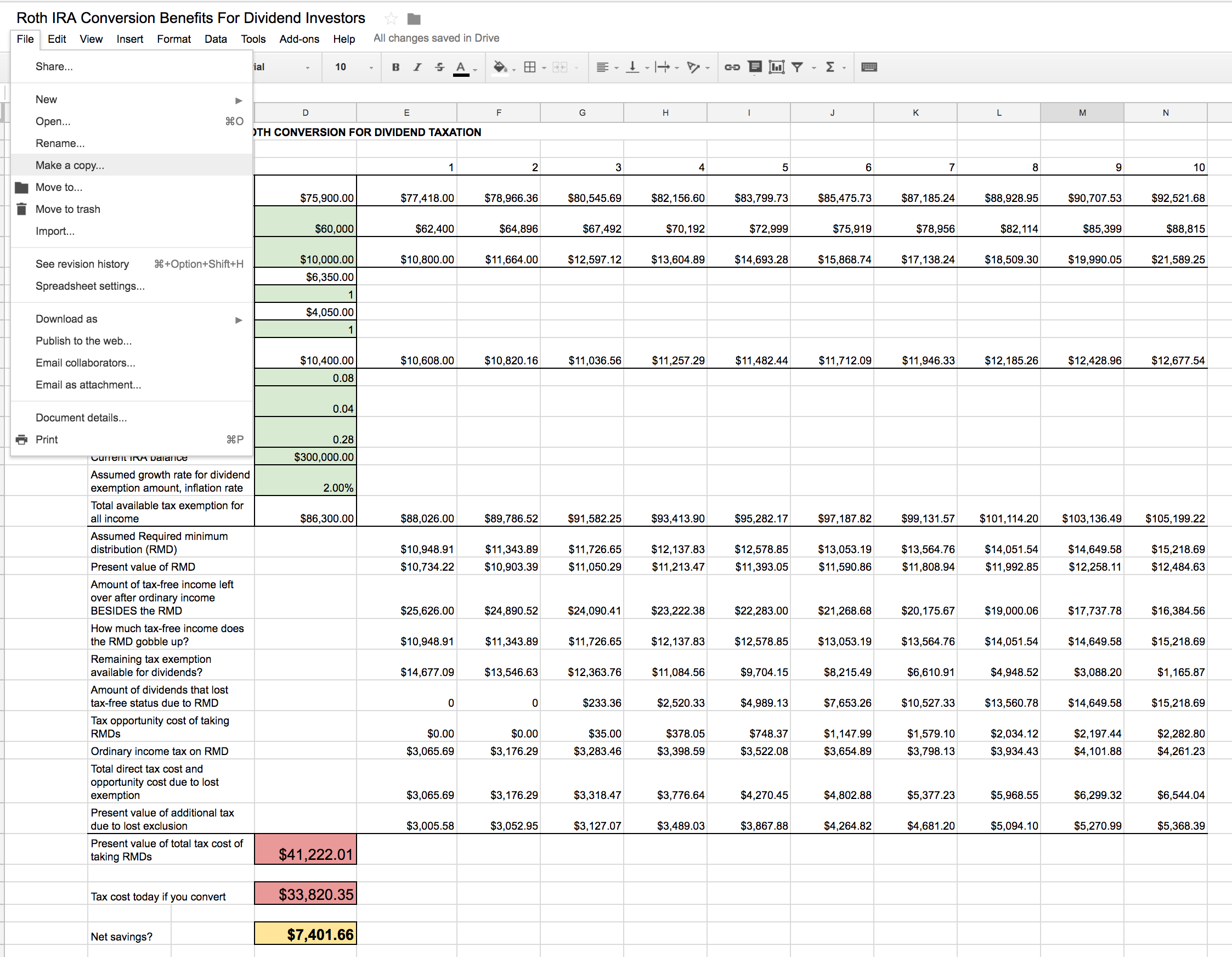

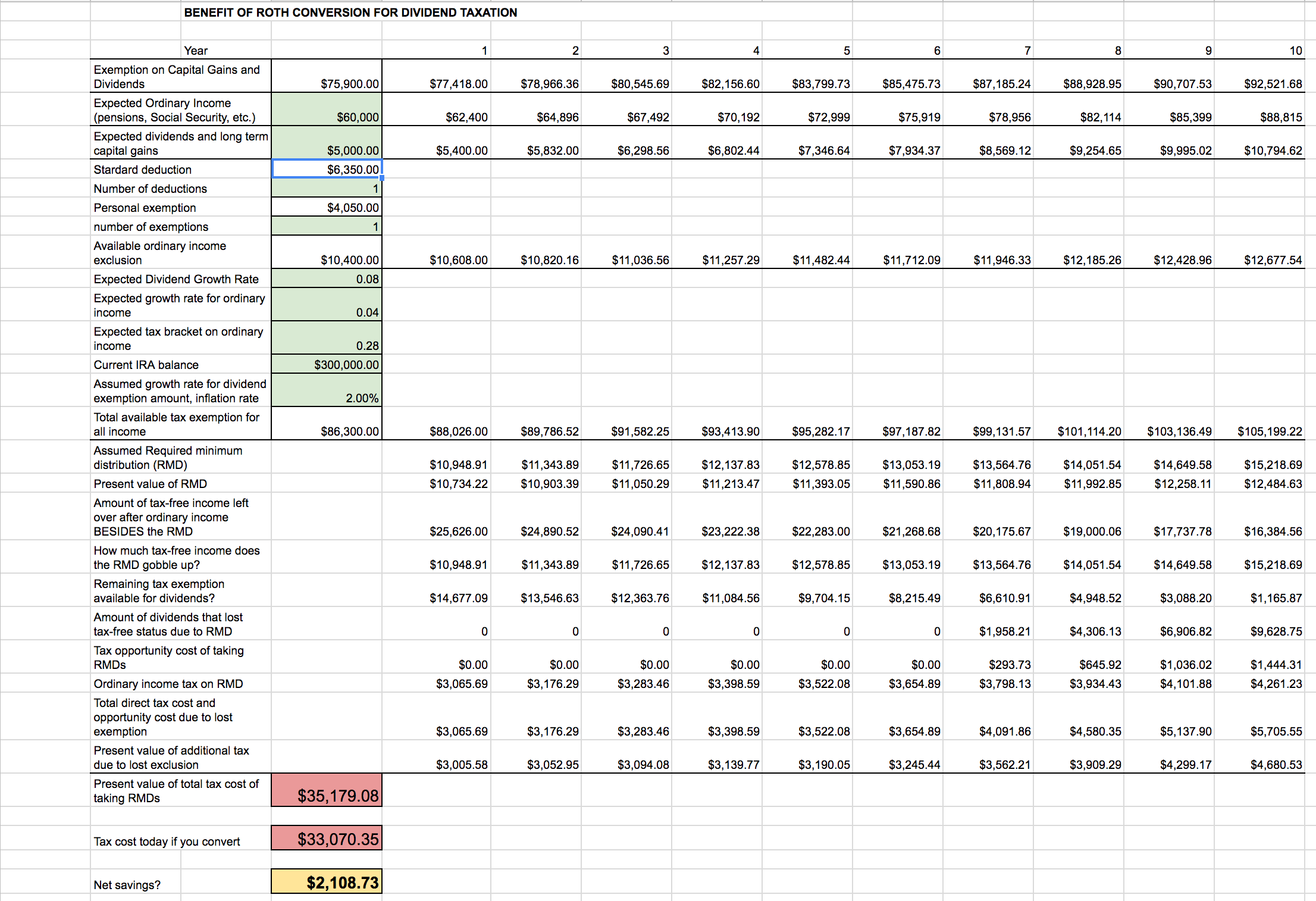

Roth Ira Conversion Calculator Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth Conversion Q A Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Roth Ira Conversion Spreadsheet Seeking Alpha

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Roth Ira Calculator Calculate Tax Free Amount At Retirement